Credit Card Fee Calculator

Input Details

Key Insights

Results

Planning a staycation in London and wondering if your US credit card a payment instrument issued by American banks that lets you borrow money for purchases will work there? The short answer is yes, but the details matter. From network acceptance to hidden fees, a few smart steps can keep your wallet happy and avoid nasty surprises at the checkout.

What Networks Do UK Merchants Accept?

Most London retailers, restaurants, and transport services support the three big global networks: Visa a worldwide payment network that powers millions of cards, Mastercard another global network with near‑universal acceptance, and American Express a premium card brand that’s accepted in most city‑center shops and hotels. Discover a U.S. network that’s less common but still works at larger chains like Harrods and John Lewis. If your card carries one of these logos, you’ll be able to tap or swipe at the vast majority of places.

Chip‑and‑PIN vs. Chip‑and‑Signature

British merchants require a Chip‑and‑PIN card technology that asks for a four‑digit personal identification number after inserting the chip. Many U.S. cards are issued as chip‑and‑signature only, which means they work for online transactions but may be declined in a physical store if the terminal insists on a PIN. To avoid this, call your bank before you travel and ask for a PIN to be assigned to your card. It’s usually free and takes a day or two to arrive by mail.

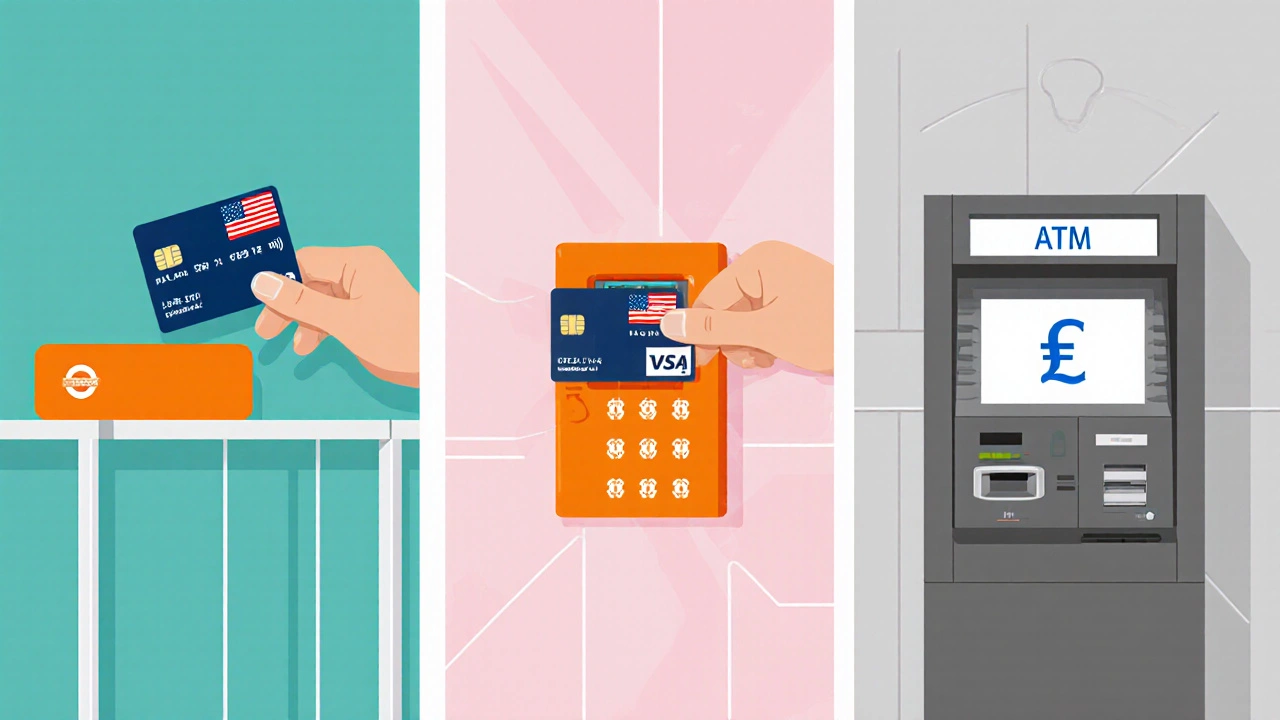

Contactless Payments Are a Breeze

London’s public transport system (the Tube, buses, and overground) loves Contactless payment tap‑and‑go technology that lets you pay with a card or mobile wallet without a PIN. If your US card is contactless‑enabled, just tap it on the orange reader and you’ll be charged in pounds. The same works at most cafés and supermarkets that display the contactless symbol. No need to carry a separate travel card.

Hidden Fees You Should Expect

Using a US card abroad usually triggers two types of fees:

- Foreign Transaction Fee (FTF) - Most banks charge 1‑3 % of the purchase amount. Some premium cards waive this fee altogether (e.g., Chase Sapphire Preferred, Capital One Venture).

- Currency Conversion Markup - If a merchant offers to charge you in USD instead of GBP, they’re using Dynamic Currency Conversion (DCC). The exchange rate is often 3‑5 % worse than your bank’s rate. Always choose “pay in pounds” to let your bank handle the conversion.

To keep costs low, pick a card with no foreign transaction fee and disable DCC whenever possible.

ATM Withdrawals: Getting Cash in Pounds

Sometimes you’ll need cash for markets, taxis, or small shops that don’t accept cards. London’s ATMs accept Visa, Mastercard, and Amex. Look for machines owned by major banks (Barclays, Lloyds, HSBC) for the best rates. Two fees can appear:

- ATM Operator Fee - Usually £1‑£3 per withdrawal, sometimes waived after a certain number of free pulls.

- Bank Withdrawal Fee - Your US bank may charge $5‑$10 for an overseas cash advance, plus the usual foreign transaction fee.

To minimize charges, withdraw larger amounts less often and use a card that reimburses ATM fees.

Travel Notification: A Simple Safety Net

Give your bank a heads‑up that you’ll be in London. Most banks let you add a travel notice via their mobile app or website. This prevents automated fraud blocks that could leave you stranded at the checkout. While the notice isn’t strictly required, it saves a lot of hassle.

What to Do If Your Card Gets Declined

Declines can happen for three common reasons:

- Insufficient funds or credit limit reached - Check your balance before you head out.

- PIN not set or entered incorrectly - Ensure you have a PIN if the terminal asks for one.

- Security block - Call the bank’s 24‑hour hotline (the number is usually on the back of the card).

While you’re on the phone, ask the rep to temporarily lift any blocks and confirm the card works overseas.

Alternative Payment Options for Peace of Mind

If you’re nervous about relying solely on a US card, consider these backups:

- Prepaid travel card a reloadable card loaded with GBP before you leave - No foreign transaction fee, but may have activation costs.

- Mobile wallets Apple Pay, Google Pay, or Samsung Pay, which store your card details securely - Works at contactless terminals and is protected by device PIN.

- Cash - Carry a modest amount of GBP for emergencies; exchange rates are best at local banks or reputable bureaus, not airport kiosks.

Best Practices Checklist

| Task | Why It Matters | When to Do It |

|---|---|---|

| Confirm card network (Visa/Mastercard/Amex) | Ensures merchant acceptance | Before booking accommodation |

| Request a PIN for chip‑and‑PIN terminals | Prevents declines at restaurants and shops | 1‑2 weeks before travel |

| Enable travel notifications | Reduces fraud blocks | Day of departure |

| Check foreign transaction fee policy | Avoids surprise extra costs | Before the trip |

| Download your bank’s mobile app | Instant access to balances and support | Before you leave home |

Real‑World Example: A Day in Covent Garden

Emily, a freelancer from Seattle, used her Chase Sapphire Preferred (no foreign transaction fee) on a Saturday in Covent Garden. She tapped her contactless card for a coffee (£4.50), paid by chip‑and‑PIN for a boutique dress (£85), and withdrew £120 from a Barclays ATM. Her bank charged 0 % foreign transaction fee, the ATM was fee‑free because she hit her $200 monthly ATM rebate, and she saved about £10 by refusing the merchant’s USD offer. The total cost? Roughly £202.50 plus a tiny $0.30 conversion rounding fee.

Quick FAQ

Will my US credit card work at the London Underground?

Yes. If your card is contactless‑enabled, just tap it on the orange reader and the fare is charged in pounds. No PIN is needed.

Do I need a PIN for my US card in London?

For chip‑and‑signature cards, many terminals will still accept a signature, but a PIN is safer. Call your bank to get one before you travel.

What’s the best card to avoid fees?

Cards that advertise "no foreign transaction fees"-like Chase Sapphire Preferred, Capital One Venture, or the Barclaycard Arrival Plus-are top choices.

Should I accept a merchant’s USD offer?

Almost never. The exchange rate is usually 3‑5 % worse than your bank’s rate. Choose to pay in pounds and let your card handle conversion.

Can I use Apple Pay with my US card in London?

Yes. Apple Pay, Google Pay, and Samsung Pay work at any contactless terminal that accepts Visa, Mastercard, or Amex. Just add the card to your wallet and tap.

Bottom line: a US credit card that carries Visa, Mastercard, or Amex will work fine in London, but a few prep steps-getting a PIN, turning on travel alerts, and picking a no‑fee card-make the experience smoother and cheaper. With those boxes ticked, you can enjoy your UK staycation without worrying about your wallet.

Menu